Net Zero Carbon at WHEB

What is Net Zero Carbon (NZC)?

NZC means cutting all greenhouse gas (GHG) emissions to as close to zero as possible, with any remaining emissions reabsorbed from the atmosphere, by oceans and forests for instance.

(NZC is different to carbon neutral because carbon neutral can cover a defined part of business operations and typically accounts only for CO2 emissions, but not other greenhouse gases. NZC on the other hand means that a company reduces all greenhouse gas emissions across its whole supply chain.)

Why does it matter?

In order to avoid the worst impacts of climate change and maintain a liveable planet, global temperature increase needs to be limited to 1.5°C above pre-industrial levels. The earth’s atmosphere is already about 1.1°C warmer than it was in the late 1800s, and emissions continue to rise.

How does WHEB’s strategy contribute to NZC?

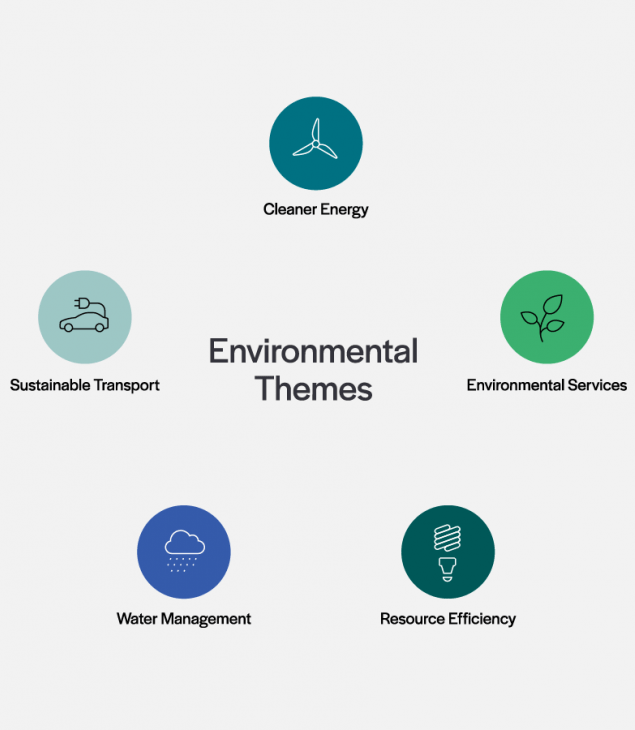

Five of WHEB’s investment themes are focused on companies that sell products or services that enable other parts of the economy to reduce GHG emissions and/or adapt to inevitable climate change. This includes companies that manufacture renewable energy equipment, components for battery electric vehicles, heat pumps and other technologies that improve energy efficiency and reduce resource use.

WHEB portfolio NZC targets

Portfolio Scope 1 and 2 emission targets and reductions

The Scope 1 and 2 emissions associated with WHEB’s investments (known as financed emissions) can change in two ways. Firstly, investing in and divesting from companies will change the total tonnes of CO2e associated with our strategy. For example, in 2021 we sold China Everbright Environment Group which dramatically reduced our financed emissions.

The second way is through actual real-world changes in annual emissions from portfolio companies. Our reporting is intended to reveal each of these dynamics. We also disclose information on the extent to which portfolio companies have set and published NZC targets and/or absolute emissions reduction targets.

As shown in Figure 1, in 2023 we saw continued, though slowing, progress from portfolio companies making net-zero carbon commitments. By the end of 2023, 82% of the emissions associated with WHEB’s strategy (financed emissions) were covered by net-zero carbon commitments. Our target is 85% by 2025 and 100% by 2028.

Notes:

Scope 1 emissions – covers emissions from sources that an organisation owns or controls directly.

Scope 2 emissions – are emissions that a company causes indirectly i.e buying energy.

Scope 3 emissions – are emissions that are not produced by the company itself, and not the result of activities from assets owned or controlled by them. Scope 3 emissions include all sources not within the Scope 1 and 2 boundaries.

Figure 1. WHEB Portfolio Net Zero Carbon targets

In terms of emission reductions, shown in Figure 2, 2023 saw a reduction in financed emissions of 6% compared with 2022. The strategy has now reduced financed emissions by 79% compared with 2019. This is well ahead of the 18% reduction that we had originally targeted for 2023. The vast majority of this reduction is due to the sale in 2021 of China Everbright Environment Group. The sale of Daikin Industries and DSM in 2023 helped to reduce financed emissions in 2023.

Less positively, we did see another annual increase in the emissions from companies that have remained in the strategy over the period. In 2023 these ongoing emissions were +3.6%. This is at least a smaller increase than the +4.4% increase that we saw in 2022. It is also much better than the +8.3% increase in emissions from the MSCI World.

In a large part the growth in the emissions from companies in WHEB’s strategy is coming from fast growing businesses that are ramping production of low and zero carbon technologies. Vestas Wind Systems for example saw their emissions grow +16% in 2023 and SolarEdge’s emissions were +30%. Nonetheless, all companies do need to reduce their emissions and the annual increase is far behind the -7.6% annual reduction in GHG emissions that the United Nations says is necessary to maintain global temperatures at no more than 1.5°C above the pre-industrial average and the -5.5% annual reduction that we are targeting.

Figure 2. WHEB portfolio emission targets and reductions

Portfolio carbon emissions

2020 – 2023

While WHEB’s investments are in companies that help reduce GHG emissions, all of our investments generate their own emissions in their day-to-day operations. We work with the management of our investee companies to encourage them to set demanding targets to reduce these emissions as far as possible and as quickly as possible.

Many of WHEB’s portfolio companies have announced a commitment to achieving net-zero carbon (NZC) emissions. Over 90% of portfolio companies with such targets have already had these approved – or are committed to having them approved – by the Science Based Targets initiative (SBTi).

Furthermore, the thematic structure of our strategy means that since the inception of the current investment strategy in 2012, we are entirely absent from parts of the economy such as fossil fuel exploration and production that are most at risk from a transition to a zero-carbon economy.

The data from the past few years across Scopes 1-3 for the whole strategy is reported in the bar charts below.

Scope 1 + 2 carbon total footprint (tCO2e) (financed emissions)

Total amount of carbon that is associated with WHEB’s investments in portfolio companies.

Scope 1 emissions - covers emissions from sources that an organisation owns or controls directly.

Scope 2 emissions - are emissions that a company causes indirectly i.e buying energy.

Explanation

The sale of higher emitting companies Daikin and DSM helped reduce emissions along with lower overall assets under management.

Carbon footprint (tCO2e/A$1m invested)

Total carbon emissions for a portfolio normalised by the market value of the portfolio.

Explanation

The sale of higher emitting companies combined with lower emissions from big emitter Smurfit Kappa.

Carbon intensity (tCO2e/A$1m sales)

Measure of average carbon intensity of investee company operations.

Explanation

Over half the emissions come from Linde and L’Air Liquide. This is somewhat offset by reductions from First Solar and others.

Weighted average carbon intensity (tCO2e/A$1m sales)

Measure of a portfolio’s exposure to carbon-intensive companies by including the portfolio weighting in carbon-intensive companies.

Explanation

As above with year on year increases at Lonza and TE Connectivity more than offset by Daifuku, Croda and Smurfit Kappa.

Scope 3 carbon total emissions (tCO2e/A$1m sales)

Measure of the carbon intensity of the whole value chain (incl. product) emissions.

Scope 3 emissions - are emissions that are not produced by the company itself, and not the result of activities from assets owned or controlled by them. Scope 3 emissions include all sources not within the Scope 1 and 2 boundaries.

Explanation

Inclusion of L’Air Liquide and higher emissions from Trane Technologies, Spirax Sarco and Xylem offset reductions from sale of Daikin Industries